Medical billing and coding procedures can be complex and challenging to navigate, especially for healthcare providers who may not have extensive knowledge in this area. One crucial aspect of medical billing is understanding Claim Form Part A. In this comprehensive guide, we will delve into all the essential details related to Claim Form Part A, including its purpose, components, importance, and common errors to avoid. By the end of this article, you will have a clear understanding of Claim Form Part A and its significance in the medical billing process.

Understanding Claim Form Part A

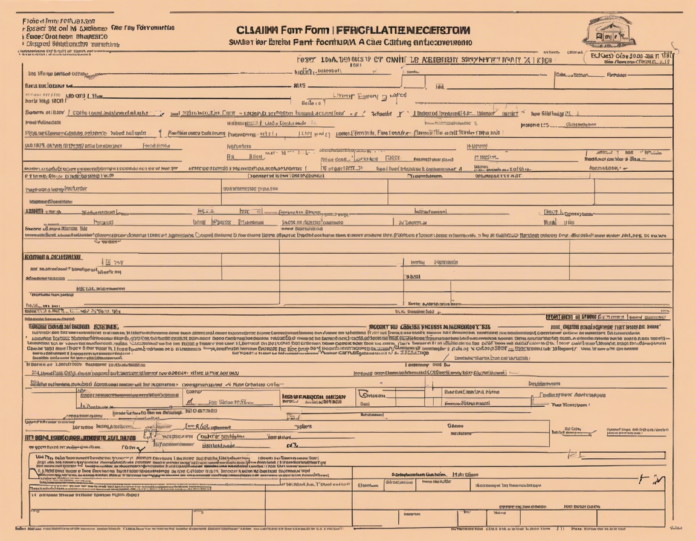

Claim Form Part A, also known as the UB-04 form, is a standard claim form used by institutional providers for submitting bills to both Medicare and Medicaid. This form is crucial for healthcare facilities such as hospitals, nursing homes, outpatient clinics, and other institutional providers. Claim Form Part A gathers important information about the patient, the services provided, and the billing details necessary for payment processing.

Components of Claim Form Part A

1. Patient Information

- Patient Name: The full name of the patient receiving services.

- Patient ID: Unique identifier for the patient, such as a medical record number or insurance ID.

- Date of Birth: The patient's date of birth for identification purposes.

2. Provider Information

- Provider Name: The name of the healthcare facility or organization providing the services.

- Provider ID: Unique identifier for the healthcare provider, such as the National Provider Identifier (NPI) number.

3. Billing Details

- Date of Service: The dates on which the services were provided.

- Procedure Codes: Codes for the services rendered, such as CPT or HCPCS codes.

- Diagnosis Codes: Codes indicating the medical diagnosis for the services provided.

4. Insurance Information

- Insurance Coverage: Details of the patient's insurance coverage, including policy number and coverage specifics.

- Authorization: Any pre-authorization or referral requirements for the services provided.

5. Total Charges

- Total Amount: The total charges for the services provided before any adjustments or discounts.

- Payment Information: Details on how the payment should be processed, including any required documents or attachments.

Importance of Claim Form Part A

Claim Form Part A plays a vital role in the medical billing process for institutional providers. By accurately completing and submitting this form, providers can ensure timely reimbursement for the services they have rendered. Failure to submit a complete and accurate Claim Form Part A can result in payment delays, claim denials, and potential revenue loss for the healthcare facility.

Moreover, Claim Form Part A serves as a documentation tool for both the provider and the payer, detailing the services provided, the medical necessity of those services, and the financial responsibility of the patient or their insurance coverage. It also facilitates communication between the healthcare provider and the insurance company, helping to resolve any discrepancies or issues that may arise during the billing process.

Common Errors to Avoid

When completing Claim Form Part A, it is essential to be thorough and meticulous to prevent common errors that can lead to payment delays or claim denials. Some of the common errors to avoid include:

1. Inaccurate Patient Information

Ensure that all patient information, including name, date of birth, and insurance details, is accurate and up to date. Errors in patient information can lead to claim denials or delays in processing.

2. Incorrect Procedure Codes

Use the appropriate procedure codes (CPT or HCPCS codes) that accurately reflect the services provided. Using incorrect codes can result in claim denials or underpayment for the services rendered.

3. Missing Documentation

Include all necessary documentation, such as medical records, referrals, and authorizations, to support the services billed. Missing or incomplete documentation can result in claim denials or audits.

4. Failure to Verify Insurance Coverage

Ensure that the patient's insurance coverage information is verified and up to date before submitting the claim. Failure to verify insurance coverage can result in claim denials or non-payment for services.

5. Billing Errors

Double-check all billing details, including charges, modifiers, and payment information, to avoid billing errors that can lead to claim denials or underpayment.

By avoiding these common errors and ensuring the accurate completion of Claim Form Part A, healthcare providers can streamline the billing process and improve their revenue cycle management.

Frequently Asked Questions (FAQs)

1. What is the difference between Claim Form Part A and Part B?

Claim Form Part A (UB-04) is used by institutional providers for billing services to Medicare and Medicaid, while Claim Form Part B (CMS-1500) is used by non-institutional providers such as physicians and suppliers.

2. Can Claim Form Part A be submitted electronically?

Yes, Claim Form Part A can be submitted electronically through the Medicare Administrative Contractor (MAC) or other approved electronic billing systems.

3. What are some common reasons for claim denials related to Claim Form Part A?

Common reasons for claim denials include incomplete or inaccurate patient information, missing or incorrect procedure codes, lack of medical necessity, and billing errors.

4. How can healthcare providers ensure timely reimbursement using Claim Form Part A?

Healthcare providers can ensure timely reimbursement by accurately completing the form, verifying patient insurance coverage, submitting all required documentation, and avoiding common billing errors.

5. Are there specific guidelines for completing Claim Form Part A?

Yes, there are specific guidelines provided by Medicare and Medicaid for completing Claim Form Part A, including instructions on patient information, billing details, and documentation requirements.

In conclusion, understanding Claim Form Part A is essential for healthcare providers to effectively navigate the medical billing process and ensure timely reimbursement for the services they provide. By following the guidelines outlined in this article, providers can avoid common errors, improve revenue cycle management, and enhance the overall efficiency of their billing operations.