Introduction

In India, the welfare and social security of citizens, especially the elderly, have always been a matter of concern. Pension schemes play a crucial role in ensuring financial stability and security for individuals after retirement. The Pradhan Mantri Vaya Vandana Yojana (PMVVY), also known as the PM Pranam Scheme, is a pension scheme launched by the Government of India to provide senior citizens with a regular source of income during their post-retirement years.

What is the PM Pranam Scheme?

The PM Pranam Scheme is a pension scheme specifically designed to benefit senior citizens aged 60 years and above. It is a policy that offers guaranteed pension payouts at a specified rate for a duration of ten years. The scheme provides financial security and stability to senior citizens who are no longer earning a regular income.

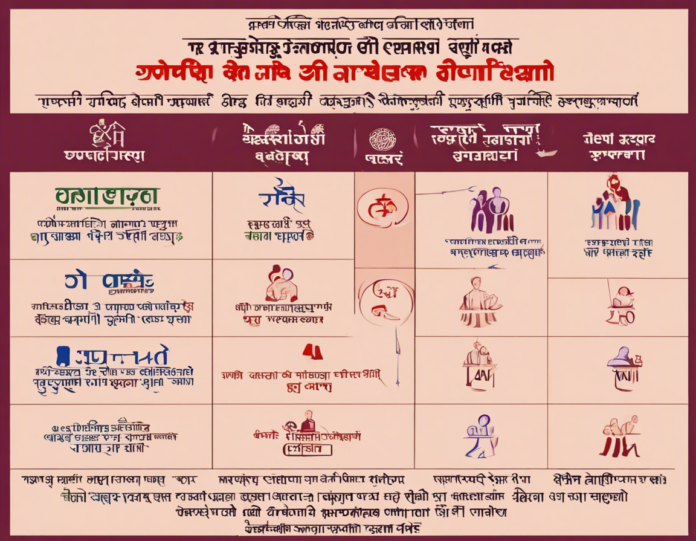

Features of the PM Pranam Scheme

The PM Pranam Scheme comes with several features that make it an attractive option for senior citizens looking for a reliable source of income during their retirement years:

-

Guaranteed Pension: One of the key features of the scheme is the guarantee of a fixed pension amount for the entire duration of ten years.

-

Payout Frequency: Pension payments are made on a monthly, quarterly, half-yearly, or yearly basis, depending on the preference of the policyholder.

-

Pension Rates: The scheme offers competitive pension rates, providing senior citizens with a steady income stream to meet their financial needs.

-

Loan Facility: Policyholders can avail of a loan against the PM Pranam Scheme to meet any unforeseen financial requirements.

-

Nomination: The scheme allows policyholders to nominate a beneficiary who will receive the benefits in case of the policyholder’s demise.

Benefits of the PM Pranam Scheme

The PM Pranam Scheme offers a range of benefits to senior citizens, making it an attractive option for securing their financial future:

-

Financial Security: The scheme provides senior citizens with a regular source of income, ensuring financial stability during their retirement years.

-

Tax Benefits: Policyholders can avail tax benefits under Section 80C of the Income Tax Act, 1961, on the premiums paid towards the scheme.

-

Nomination Facility: The scheme allows policyholders to nominate a beneficiary, ensuring that the benefits continue even in the event of the policyholder’s demise.

-

Loan Facility: Policyholders can avail of a loan against the scheme, providing them with liquidity in times of need.

Eligibility Criteria for the PM Pranam Scheme

To enroll in the PM Pranam Scheme, individuals need to meet certain eligibility criteria:

- The scheme is available to Indian citizens aged 60 years and above.

- The minimum purchase price for the scheme is Rs. 1.56 lakh, with no maximum limit.

- The scheme is available for a limited period, so individuals need to apply during the specified enrolment period.

How to Apply for the PM Pranam Scheme

To apply for the PM Pranam Scheme, individuals can follow these steps:

- Visit the official website of the Life Insurance Corporation of India (LIC).

- Fill out the application form for the PM Pranam Scheme, providing all the necessary details.

- Submit the form along with the required documents and the premium amount.

- Once the application is processed and approved, the policyholder will start receiving pension payments as per the chosen frequency.

Frequently Asked Questions (FAQs)

- Who is eligible to apply for the PM Pranam Scheme?

-

Indian citizens aged 60 years and above are eligible to enroll in the scheme.

-

What is the minimum purchase price for the PM Pranam Scheme?

-

The minimum purchase price for the scheme is Rs. 1.56 lakh, with no maximum limit.

-

What are the payout frequency options available in the PM Pranam Scheme?

-

Pension payments can be received on a monthly, quarterly, half-yearly, or yearly basis.

-

Are there any tax benefits associated with the PM Pranam Scheme?

-

Yes, policyholders can avail tax benefits under Section 80C of the Income Tax Act, 1961.

-

Can a policyholder avail of a loan against the PM Pranam Scheme?

- Yes, individuals can avail of a loan against the scheme to meet their financial requirements.

Conclusion

The PM Pranam Scheme is a valuable initiative by the Government of India to provide financial security and stability to senior citizens during their post-retirement years. By offering guaranteed pension payouts, tax benefits, and loan facilities, the scheme aims to address the financial needs of the elderly population and ensure that they lead a dignified and comfortable life. Senior citizens looking to secure their future can consider enrolling in the PM Pranam Scheme to enjoy the benefits it offers.